In this article, I am going to use my experience as a Director of Retention Analytics for a major US cable company to explain how to calculate the churn rate that will work for your business.

I will go over the definition of metrics used in the churn rate calculation as well as closely related terms such as attrition and survival.

Lastly, I will provide recommendations on how to report on churn metrics.

Definition

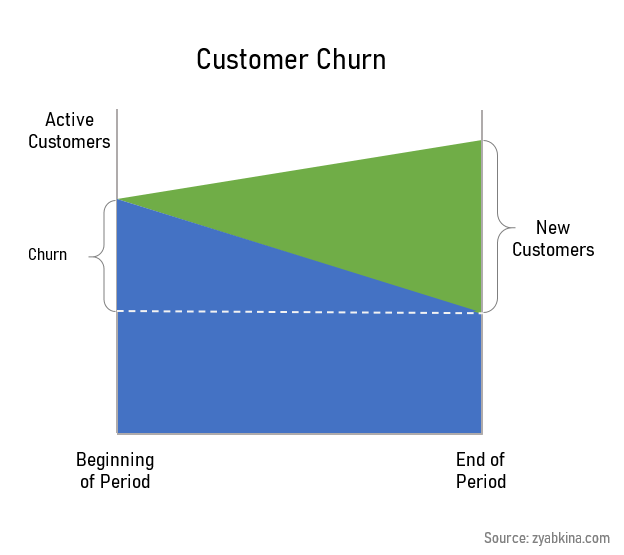

Churn rate over a period of time is the number of customers who went from being active to being inactive over that period divided by the number of active customers at the beginning of the period.

There are many intricacies of defining churn that can be applicable to certain industries. Let’s go over them.

Two Types of Metrics

Fundamentally, there are two types of business metrics, the snapshot metrics, and the flow metrics.

The snapshot metrics are only valid on a particular date: your account balance on a date, your marital status is valid on a particular date, your address on a particular date.

The flow metrics are valid over a period of time. Your expenses over the last year, your income over the past month, the number of kids you had in the past decade are all examples of flow metrics.

Active Customer

The definition of an active customer is at the core of defining the churn rate. Customer status is a snapshot metric, i.e. it can only be measured on a particular date. A customer can be active or inactive on any given date.

While this distinction can be clear for some business, others may have to give it more thought. For example, providing free services

Two Businesses Models

Business models can be roughly classified into subscription and transactional.

Subscription businesses sell services that cover a particular period of time, like telecommunication services, banking relationships, insurance coverage.

A subscription customer is considered to be active during the coverage period, and inactive outside of that period of time.

Transactional businesses sell products by individual transaction, which don’t form a subscription. For example, retail purchases, restaurant meals, home renovations. They usually price their offering per product.

For transactional businesses, an active customer on a certain date is defined as someone who had had a transaction within a certain period of time before that particular date. Therefore, to define an active customer in a transactional business, you need to define the active customer window.

For example, if you define your active customer window as the prior 90 days, then active customers as of January 1, 2021 are every customer who had a transaction between October 3, 2020 and January 1, 2021.

The churn metrics make the most sense for subscription businesses, however, they are also applicable to transactional businesses. Sometimes transactional businesses use different terms or additional metrics, which I will note.

Churn

A customer is considered to have churned if they go from active to inactive during a period of time. Churn is a sum of all customers that churned during that period of time. It is a flow metric.

The metric seems straightforward, but practice shows that its interpretation can be different in different businesses. For example, some cable systems count customers who transfer service to a new address as churned, and some don’t. I have also seen when the definition of churn changes over time, usually to fit certain narratives put forward by the businesses.

It is very important to make sure your definition is consistent, over time and across company divisions. And your definition of an active customer should guide you on who should be truly counted as churned.

Some transactional businesses add another status in between active and inactive, called lapsed. A customer may go into active status into lapsed, and then churned based on how long ago they had their last transaction.

Churn Rate

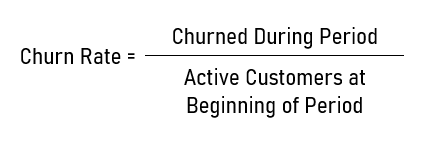

Churn rate is the number of customers who went from being active to being inactive over a set period of time divided by the number of active customers at the beginning of that period.

The number of active customers is often called the active customer base. Thus, the churn rate over a period of time can be expressed as total churn during that period of time divided by the active base.

Commonly, the churn rate is calculated on a monthly basis, but there are also weekly, quarterly, and annual churn calculations.

Two Ways to Treat New Customers

Did I mention the churn rate can be tricky? Let’s look into the tricky parts, then.

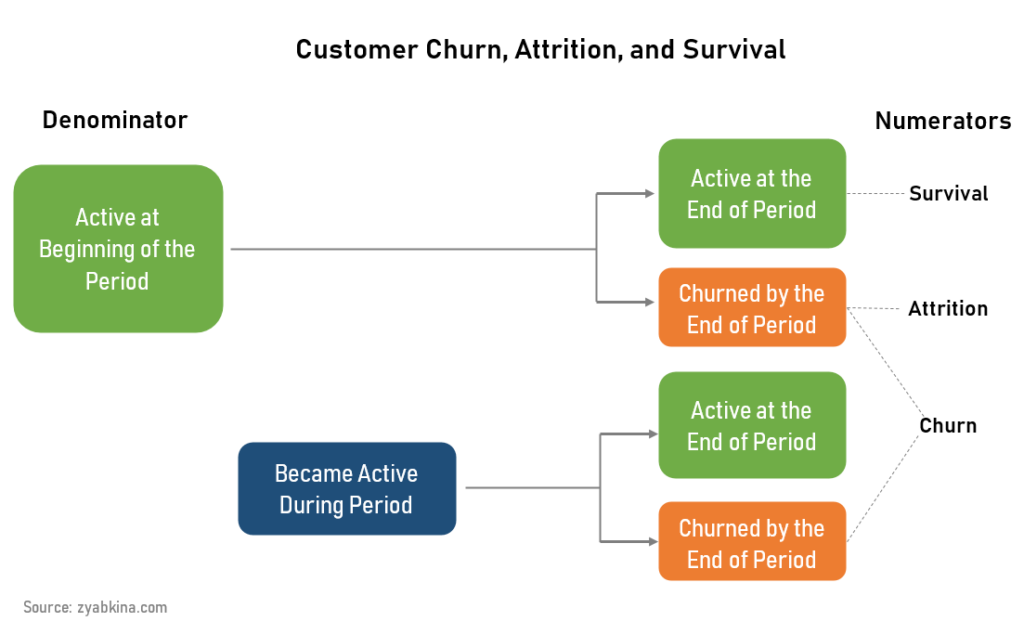

Even though this churn formula is very precise, there is some uncertainty about how you treat customers who became active and then went inactive during our measurement period.

For example, if we measure the churn rate for the month of June, how do we treat subscribers who were not active at the beginning of June, became active during the month of June, and then became inactive by the end of June?

Often, we would disregard these subscribers because their number is very low. In this case, our formula can be simplified. We can take all active subscribers at the beginning and the end of the period, compare them, and the subscribers that were active at the beginning but not at the end are our churned customers. This metric is called the attrition rate.

However, this simplification interferes with the metrics if we are looking at a longer period of time, like an annual churn metric. Many customers do “round trip” during a year, and we should absolutely accommodate for that by including all of them into the churn count.

Nonetheless, we should never include not-yet-active customers into the numerator, i.e. the count of active customers at the beginning of the period.

Churn and attrition rates are two ways of looking at the churn and they provide us with different views of the business. Both offer a unique perspective.

When you conduct churn analysis and start splitting your churn rates into the segments as I show in this article, it becomes very hard to include new “round trip” customers into the numbers because they don’t exist in the peginnign of the period snapshot.

Therefore, it is much easier to analyze the attrition rate as an approximation of the churn rate. If you are using short analysis periods that only get a few round trips, like one month or one week, then simplifying the analysis is not a problem.

There is a lot of detail that go into the churn numbers, and that’s why you should always ask exactly how the numbers were calculated when presented with the churn, retention, or attrition rates.

Monthly vs Annual Churn and Attrition Rates

Every business is seasonal, and customer churn is not an exception. Be prepared to have different levels of churn in different months of the year.

If you are using my expanded definition of churn rate that includes new customers, then your annual churn is the sum of monthly churn through the year, and your annual churn rate is the sum of monthly churn rate over the year.

Please note that for some businesses this churn rate may exceed 100%. It’s not an area of concern of its own, but you probably have a very high churn business if your annual disconnects or inactivations exceed your active base.

If you are disregarding new customers and looking at the churn of those who were active at the beginning of the period, then you are calculating the annual attrition rate, and it is going to be quite a bit lower.

The annual attrition rate is the percentage of the customer base active at the beginning of the year that has churned over one year. The attrition rate can never go above 100%.

The opposite of the attrition rate is the survival rate. That’s the percentage of customers who are still active at the end of the period.

In transactional businesses, the survival rate is often called the repurchase rate. This comes from the fact that to stay active, the customer needs to make another transaction.

What is a Good Churn Rate for a Subscription Business?

Most telecommunication subscription businesses have a monthly churn rate of around 2%. That number is for the whole customer relationship, not the the individual product relationship.

However, different subsegments of the business may have vastly different churn rates. For example, I have seen rates as high as 8% a month and as low as 0.5%, which I would consider being normal. Since tenured subscribers are less likely to churn, the disconnect rate for those who have been around for five years tends to be very low.

Another factor to consider is the churn reason. Based on my definition, churn is reason-agnostic, covering all reasons for disconnects. It is not correct to assume that most of this churn is driven by customer dissatisfaction in one area or another.

For example, as much as 30% of early churn in the telecom industry happens due to non-payment. Another big chunk of disconnects in wireline services is due to customers moving. These reasons need to be paid attention to when calculating and reporting churn rates.

Churn Rate and Subscriber Tenure

For subscription businesses, customer tenure is one of the largest factors impacting customer churn rate, with the churn rate going down over the tenure of the customers in all businesses.

This is based on a very simple calculation. If your expected customer lifetime is 5 years, then on average, a group of such customers churns at 20% a year or 1.7% a month.

If your customers expected lifetime is 6 months, then their monthly churn rate is 16.7% a month.

If you take a group of short-tenured customers, you are going to have a mix of expected lifetimes in the group, but your shorter lifetimes are going to be over-represented because they are the ones coming in and out of active status most.

If you look at a group of longer-tenured customers, then few of the short lifetime subscribers are going to be there, and you are naturally going to be left with customers who have a longer expected lifetime.

I describe this dynamic in great detail in my churn analysis article, and I highly recommend doing tenure analysis as the first step of churn analysis.

Transactional Engagement Metrics

In place of tenure, transactional businesses use recency, frequency, and monetary value, or RFM. These metrics are also aimed at understanding how engaged the customer is with the product and how likely they are to continue purchasing.

The function that tries to increase customer life in transaction businesses is called loyalty. Its goal is to make sure the customer repurchases the company’s product as long as possible.

Churn Rate Reports

For a subscription business, the following churn reports make the most sense. All of these metrics should be run for at least 13 months because churn is seasonal, and we need the prior year’s baseline to compare to.

- Total churn rate

- Churn rate by product line

- Churn rate by customer tenure

- Churn rate by reason

- Churn rate by region

Conclusion

Churn rate can be calculated for both subscription and transactional businesses. There are multiple ways to calculate churn rate, and there are other similar metrics that can be looked at, such as attrition rate, survival rate, lapsed rate, recency, frequency, etc.

Now that you learned how to calculate the churn rate, it is time to analyze churn. Hop over to this article to learn more about churn analysis.

If you need help understanding your churn data, please connect with me on LinkedIn and send me a message.